INTERNATIONAL: Asian shares retreated on Thursday, in line with a global selloff, as markets were spooked by more aggressive noises from U.S. policymakers about the need for tighter monetary policy, which also kept the dollar near a two-year peak.

MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) fell 1.17% to its lowest level in a week, while Japan's Nikkei (.N225) dropped 1.9%.

European and U.S. share futures also fell. EUROSTOXX 50 futures eased 0.2%, S&P 500 futures fell 0.37% and Nasdaq futures fell 0.35%.

"The whole political and policy stance in the U.S. has shifted, and markets are starting to get that," said Redmond Wong, a market strategist at Saxo Markets Hong Kong.

"Attention has really moved towards quantitative tightening after all those Fed speakers and the minutes yesterday, and the objective is to tighten financial conditions and depress aggregate demand. I think the Fed is willing to accept some softness and wants to cool down the labor market, unlike in the past, when they wanted to protect it."

Minutes of the Fed's March 15-16 meeting released on Wednesday, showed deepening concern among policymakers that inflation had broadened through the economy.

U.S. Federal Reserve Governor Lael Brainard said on Tuesday she expects rapid reductions to the central bank's balance sheet.

Wong said that in the long run positive real interest rates would be good for the global economy, but in the medium term there would be a repricing of assets.

Overnight all three major U.S. benchmarks fell, with the Nasdaq Composite (.IXIC) worst hit, losing 2.22%.

Also on investors' minds was growing economic strains in China, which is grappling with new outbreaks of COVID-19.

Shanghai, currently under a city-wide lockdown, reported nearly 20,000 new cases on April 6 - the vast majority asymptomatic - the local government said on Thursday.

Nomura estimated on Tuesday that a total of 23 Chinese cities have implemented either full or partial lockdowns, which collectively are home to an estimated 193 million people and contribute 22% of the country's GDP.

Chinese blue chips (.CSI300) shed 0.9%, and Hong Kong stocks (.HSI) lost 1.3%, weighed by declines in large Chinese tech firms (.HSTECH)

U.S. Treasuries had sold off sharply in the lead-up to the release of the Fed's minutes, sending yields to multi-year highs before steadying.

The yield on 10-year Treasury notes was little changed in Asia trade at 2.5865% while the 2-year note yield was slightly softer at 2.4554%, leaving this closely watched part of the yield curve slightly steeper after starting the week inverted.

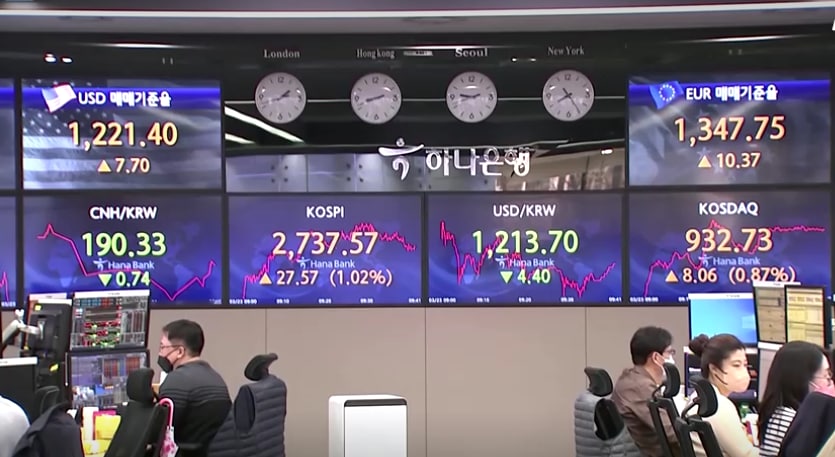

In currency markets, the prospect of quantitative tightening in the United States kept the dollar near a two-year high against a basket of currencies.

The index was at 99.537, just off the overnight peak of 99.778, also supported by commodity currencies' retreat from recent highs due to a dip in oil prices, and a decline in the euro.

The European common currency inched up from a one-month low overnight, weighed down by what ING analysts called a "double threat" from the economic impact of new sanctions on Russia for its war in Ukraine and uncertainty about the outcome of the French election.

Oil prices rose on Thursday, however, after falling to a three-week low the day before after large consuming nations said they would release oil from reserves to counter tightening supply.

Brent crude futures were up 1.45% at $102.55 a barrel, while U.S. crude rose 1.3% to $97.48 a barrel.

Spot gold fell 0.23% to $1,920.9 an ounce.